jgarzik ” $INTC factories, the documents suggested, were responsible for at least two generations of @21dotco bitcoin mining chips”

@gigq Sure; there were some Germans claiming huge energy savings but also 21.co might cause ASIC proliferation.

@gigq I only forsee it following the price if there are no more advancements in ASICs, which also seems unlikely.

RT @gendal: My new post “Ignore Bitcoin at your peril?

Does Nasdaq announcement show you need blockchain *and* bitcoin strategy?†http://t.…

@mikestable stop hotlinking, brah

pig_poetry @lopp Nonsense! No true scotsman abandons an argument.

Know your fallacies => know when to stop wasting time arguing with illogical opponents. http://t.co/vrLHjBwnEK

@Bullionbasis Different types of monetary instruments have different properties and thus different risks associated with using them.

@Bullionbasis There is no such thing as “true money” - the value of a monetary instrument is in the eye of the beholder.

@DrRoyMurphy We may yet see more innovation in mining, if not via more powerful ASICs, by cheaper and more plentiful embedded ASICs.

@DrRoyMurphy Stagnant BTC price + ASIC tech nearing limits of silicon fabrication tech seem likely culprits.

@coolbearcjs Tends to be related to the exchange rate of BTC (due to block reward) and advances in mining technology (ASIC design)

@coolbearcjs It’s just an (estimate) of the amount of computational power that people are devoting to securing Bitcoin via mining.

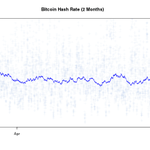

Hashrate has really plateaued the past few months. Seems unlikely to last… pic.twitter.com/ooL9kWDzFG

@Bullionbasis Bitcoin doesn’t work without power, just like all modern fintech. In event of global power loss, we’ll have bigger problems.