@mikejcasey @prestonjbyrne @pascalbouvier @dgwbirch Thankfully open marmot carry is not prohibited.

@cguida6 @TradeBlock That’s the default, but miners could hold them longer /or/ the sender can just rebroadcast them.

@AriannaSimpson Did you ever write about your Tesla incident?

US national average is 1 fatality per 100M miles driven.

Tesla autopilot is at 1 per 130M & will certainly improve.

https://t.co/0GyxSp4iqj

@rubensayshi @JihanWu @kristovatlas Of course; post was labeled FUD and locked fairly quickly.

@JihanWu @kristovatlas Ha, I see what you did there. But I think the main question is if there is much support for this proposal.

@maraoz I’m not, but I don’t understand it that well. Seems like a massive undertaking.

@kristovatlas Can @JihanWu confirm this story?

@masonic_tweets @maraoz @TuurDemeester Funny thing about TA is that TA may reinforce itself. Self fulfilling prophecy feedback loop?

@maraoz @TuurDemeester Because Bitcoin can’t stand still, so if it does go sideways for long enough, you know it has to move?

@TuurDemeester The triangle is working its magic!

bradheath Fun 4th Am. fact: To challenge gov’t search of a box of drugs, you must first claim that it’s *your* box of drugs. pic.twitter.com/AcYhLmrOsy

bradheath UPS “reserves the right in its sole discretion to open and inspect any package tendered to it for transportation.” pic.twitter.com/BRYkS9iLk2

The mempool is so empty that BitClub Network just confirmed a bunch of 9 month old low fee UTXO consolidation txns. https://t.co/CNOTnOiED7

WayneChain is always correct because transaction errors are fixed via time travel! https://t.co/TZ8LM8bSCa

@masonic_tweets Can you explain Urbit in 140 characters?

@washingtonpost @pmarca Technology keeps advancing & the new models are more exciting every year! I’m still waiting for blaster pistols…

encryption

pseudonyms

cryptocurrency

anonymous networks

zero knowledge systems

identityless reputations

truly free markets

cryptoanarchy

@theonevortex @maidsafe @TuurDemeester Hard to compare; I’d say @urbit_ has much grander ambitions. https://t.co/1392Rs60ug

If you thought the <COLOR> Hats have been having a field day with Solidity’s attack surface, wait ‘til they sink their teeth into @urbit_.

Over the long term, holding stock market index funds is nearly guaranteed to be profitable. https://t.co/b43TOQfbs1 https://t.co/ccP2DUfFHn

.@coinbase & @circle are only licensed BTC money transmitters in NC; @coinxinc was denied. https://t.co/iTtj8oQsLv https://t.co/ZyuowU4wGe

An explanation of how completely innocent people can invoke the Fifth Amendment to avoid incriminating themselves. https://t.co/aJX2RmX0eo

@derosetech (right) & @junseth (left) trolling @MiamiNewTimes https://t.co/e18JojvvPz https://t.co/oscdLmAfC7

@Bitcoin Several-day-old posts about price movements are confusing :-/

@Truthcoin I’d try to get direct answers from the pools for more clarification; @james_hilliard tells me that CKPool doesn’t SPV mine.

@TuurDemeester And those are just the forks you can count (forked via github’s UI.) For example, XT isn’t counted: https://t.co/9euDVGwrj7

@brian_armstrong It would also be amazing to build a version of Slack that doesn’t use 100% of your RAM.

@TradeBlock Regarding “unknown” miners:

@YourBTCC: https://t.co/y5kNiH002F

@HaoBTC: https://t.co/dgRmngnz9U

Good guy AI chatbot successfully contests 160,000 parking tickets for free. https://t.co/hF7NvpjUDY

@masonic_tweets You know what makes a great Faraday cage?.50 cal ammunition cans.

@hrdng It could but from the blocks I examined, the huge txns were many inputs to 1 output.

@seweso It was significant for the blocks I saw yesterday. The fast low fee blocks had about a quarter the average fee rate.

OKC bar manager jailed for 3 days for putting strips of bacon inside bottles of vodka. Sounds like a @CrimeADay https://t.co/iYnWKgmUiB

TL;DR don’t take custodianship of digital assets on behalf of North Carolinians unless you have money to burn. https://t.co/gExTAify1t

Only 43 perfectly full 1,000,000 byte Bitcoin blocks have ever been mined. All of them by @f2pool! ðŸ’ðŸ’ðŸ’ðŸ’

Most recent: https://t.co/Kxh73NhGyd

@james_hilliard Nope, haven’t seen empty blocks from CKPool

@james_hilliard IDK, I’m just noting a behavior change I’m seeing. We’re still seeing the occasional empty block, though…

4) I consider this an improvement because instead of the miners giving us empty blocks, they’re cleaning up the UTXO set.

3) This is probably a “safe†strategy b/c fee rates are so low, miners are nearly assured that they weren’t mined in the parent block.

2) For example

F2Pool mined this block 7s after prev: https://t.co/GPOdUjUNiO

CKPool mined this block 9s after prev: https://t.co/DHbfxp3AJX

1) It seems some pools have new logic to mine huge low-fee txns after a new block is detected but before they’ve updated their mempool.

TIL my local credit union has to have its coin counting machines serviced every few weeks to remove random items such as live ammunition.

NinjaEconomics European bank stocks are getting battered. Down 22% since the referendum on.ft.com/291F8WQ pic.twitter.com/x1XgjdgMHf

Huge if true. Proof that Technical Analysis of BTC markets is 💩?— @VinnyLingham https://t.co/8AxNULKXL2 https://t.co/V5RBmwyyCJ

@pierre_rochard Though it seems that @eris_ltd is doing a pretty good job handling the “worst case” scenario for smart contracts.

@pierre_rochard I think it comes down to: best case scenario, they blow normal contracts out of the water. Worst case: neightmare.

@AlpacaSW @dgenr818 @santisiri If you’re running reasonable contracts that don’t screw over a significant portion of users, should be fine.

@AlpacaSW @dgenr818 @santisiri It appears the fine print doesn’t meet the community’s expectation of reasonableness. https://t.co/fCYrxatch0

bradheath Federal court: Computers connected to the internet aren’t private, have no 4th Am. protection. Expect to be hacked. pic.twitter.com/dHK1g9LpJh

4) Thus you shouldn’t use a public permissionless blockchain unless you believe most people are moral & rational. I, for one, do believe it.

3) Historically, this only tends to happen defensively when an individual first screws over a decent portion of the collective userbase.

2) That is: if “everyone” using a public blockchain decides it’s in their best interest to collectively screw you, you will get screwed.

1) Public permissionless consensus systems let you use them w/o trusting any one individual. However, you must trust everyone in aggregate.

@dgenr818 @santisiri It’s not a bug in ETH, but meatspace consensus is that the bug should be corrected…

@WhalePanda The issue is code execution vs intent of the code devs. It’s not a coincidence that both incidents received the same response.

@santisiri seemed different initially bc the bug was at app layer, but now there are good arguments that protocol layer wasn’t well defined.

@santisiri If by “real bug” you mean the code did not execute the intent of its authors… I don’t see the difference.

One perspective: both “billion BTC” & “DAO attacker” get to keep their tokens, but everyone else has decided to use a different blockchain.

@fluffyponyza Either way, it appears that intent is more powerful than code when it comes to distributed consensus systems…

If DAO attacker deserves to keep tokens b/c they followed rules, doesn’t whoever created 184B BTC in 2010 as well? 🤔https://t.co/324157Vz5W

@govtechnews @jgarzik Myself and @coincenter tend to dispute the “friendliness” of said legislation.

@ollekullberg My point is that a lot of volume flows through a small number of popular services that take custody of bitcoins.

@ollekullberg No, some examples would be: Bitcoin exchanges / brokers, payment portals, remittance providers, gambling services…

@ollekullberg I’m referring to popular custodial Bitcoin services.

6) No doubt detractors will decry these “centralized hubs†but in reality they were already “centralized†for on-chain txns.

5) Enter Lightning Network. Once popular custodial services support it, they can reduce on-chain txn volume & retain privacy.

4) This presents a huge privacy issue - is sacrificing privacy worth decreasing the load on the blockchain? Doubtful many would agree.

3) However, popular custodial services can only implement periodic settlement if they know which addresses belong to which services.

2) Settlement could occur in trusted fashion with out-of-band “IOU†updates, or trustlessly via updating high value payment channels.

1) A great deal of on-chain txn volume occurs between popular Bitcoin services. It could be reduced if they only settled periodically.

MTGOX (Magic The Gathering Online eXchange) is open for business on @openbazaar at ob://@_mtgox/store pic.twitter.com/I2U10Qqs4u

.@fluffyponyza says we need a model for CONOP (Cost of Node Option) - overlaps my argument that we need a node spec. https://t.co/4XYdmZr0mW

Great talk by @fluffyponyza on challenges of building a max block size algo that won’t increase cost to run a node. pic.twitter.com/JCh9EaOWDH

naval Four sovereigns in history: tribe, king, corporate state, networked individual. All still here, unevenly distributed, and in conflict.

Segregated Witness has been merged into @bitcoincoreorg https://t.co/QuVM77tChZ

RT @OnChainScaling: The conference has started. If you have not registered you can use this link for today https://t.co/Awd269dZ8E

The extremely wealthy would only need to put a small fraction of their investments into BTC to send it to the moon. https://t.co/gPZkpDJ9b5

RT @jonmatonis: My bet for the smart contract ecosystem is on @SDLerner: Lessons from the DAO Incident https://t.co/e9RYZlLPuy @RSKsmart

qz World currencies are tanking on Brexit, but bitcoin is surging qz.com/715681

https://t.co/DkfqFjbjiM is pretty nifty - it made it easy to find a few “satoshi addresses.”

https://t.co/9NboJ04vj1

https://t.co/2baBiVXbKK

@kristovatlas Have you checked out blockchainSQL? Seems to work pretty well; I haven’t been able to break it. blockchainsql.io/8Nou50

I tell ya, that pound is far too volatile to be used as a currency! /s https://t.co/qvGqP0EWmx

@bitcoin3000 Time is definitely a key component; every day without a successful attack adds a little more psychological security.

@oditorium I think hype + fact that Ethereum’s track record was yet unblemished resulted in too much trust in the smart contract code.

santisiri @lopp today investor and corporate contracts are also written in a dark language known only to experienced lawyers.

4) Trustless blockchain + untrusted code = ?

3) Thus, either smart contract investors are limited to a handful of techies (pointless) or investors must trust reviews from these people.

2) But there’s a problem: a smart contract’s terms are the byte code + EVM behavior. Likely fewer than 1,000 people globally can review it.

1) It’s easy to snark that “anyone investing in a smart contract must read the terms first” & thus investors deserve to lose money to flaws.

The world’s first Cypherpunk hedge fund. https://t.co/z80exsFIxs

Next up: Segregated Witness. https://t.co/eGDbgnXYNk

As expected, the “White Hat” DAO counterattack has triggered another cycle of attacks. https://t.co/J1htE0PdGE

@masonic_tweets Ooh ooh, I know this one: it’s for scalability, right?

@AustenAllred Last I checked, quite a few people ascribe to the Keynesian theory that inflation is desirable. pic.twitter.com/wPqaQGjqKv

@jefft Next @bronto assassin? https://t.co/wKQ3gTXJUG

@paulg @BrendanEich already did - it’s called @brave

@kristovatlas I didn’t even know about Authy OneTouch; I guess none of the services I use support it…

Google Prompt is simplifying 2 factor authentication. I just set it up - it’s a breeze! https://t.co/qvGFemCBIB

@Papirys1 @masonic_tweets I’d say it’s both :-)

@alansilbert I wish it had worked for all the wars of aggression :-/

Unveiling of Solidity exploits will surely slow down development as projects reallocate more resources to security. https://t.co/Dde46N1OIl

@alansilbert Deadlocked government is my favorite kind of government.

@ErikVoorhees Even more generally: https://t.co/T3yVnwIYER

RT @wrmead: NYT reports on the rolling catastrophe that is America’s occupational licensing regime:

https://t.co/YGXU5x9pbK

@badslinky $1.5M probably can’t even buy a single supercomputing cluster! ;-)

@bradheath @jgarzik Aren’t /most/ Americans armed? Using that logic, no-knock warrants are always reasonable.

ryaneshea Irreversible truth exists in the real world. It’s called reality. And a universe of possibility awaits once we have digital irreversibility.

A blockchain can only be as immutable as its community wants it to be. Meatspace consensus trumps machine consensus.

RT @jerrybrito: How to improve North Carolina’s digital currency bill https://t.co/meumj7pFCr

@barrysilbert @LRB It’s entertaining but unfortunately hard to take any of the content as factual given the fallout.

@Steven_McKie Sounds like a mess.

Ethereum will keep operating regardless of a soft / hard / no fork. Only difference: we’ll have a better idea of what Ethereum actually is.

@twobitidiot Jargon is just an old-fashioned form of compression: necessary for twitter :-D

@oditorium @twobitidiot State is a pretty general term for “every piece of data comprising a system” so it should work.

@twobitidiot How about: a tamper evident database comprised of historical state changes.

@SDLerner I think what he meant was that the coinbase of block 9 was spent to create the transaction. Amateur phrasing error.

Craig Wright claimed to have met with Ross Ulbricht. Also claims that only 100K BTC are his. https://t.co/zFzlEDzOl5 https://t.co/q3fNYTXDQp

Several interesting claims & 1 dumb remark by the author. https://t.co/zFzlEDzOl5 https://t.co/JQNbsXeqKP

“Submissions that are mostly about some other cryptocurrency belong elsewhere, unless they are schadenfreude.” - /r/bitcoin

Improvements:

1) @DefDist has you covered with Ghost Gunner

2) Only takes a few clicks to set up a bitcoin wallet

https://t.co/aAKt9U1Dan

TuurDemeester $ETH falling like a rock vs. Bitcoin: -48% in 48 hours… pic.twitter.com/TAwx5dgtkz

Impossible to predict which would cause greater loss of confidence in Ethereum: forking or not. Other blockchains have tried both & tanked.

@jgarzik @JohnCollins “It’s not a bug, it’s a feature!”

@grillmaestro A search of my tweet archive shows that I haven’t tweeted at @WCPSS … odd. https://t.co/wJfMgAK3Wl

@grillmaestro Oh my, it appears that @WCPSS blocked me. I wonder if I hurt their feelings at some point.

@christi68920324 With the existing consensus algorithm. You can read more here: en.bitcoin.it/wiki/Softfork

@kristovatlas Value is above 0 - it survived! :-D

@christi68920324 Just discussions so far. The difference between forks is that soft forks are backwards compatible while hard forks aren’t.

BTC->USD at -2% today. $GBTC at +9%. $GTBTC premium at 97% over NAV. Do I hear 100%? Any takers?

RT @Zd3N: Level 2 of #Bitcoin #Crypto #Puzzle - Find private key in this image - Follow up: https://t.co/dGOD1Q9xQE https://t.co/rmKKnyfrkm

@cryptotraveler No, but if you read Vitalik’s thoughts on consensus then it shouldn’t be surprising: https://t.co/bU9V9CgYZ7

@cryptotraveler Not “some guy,” but rather the network validators. It’s still a form of distributed consensus.

@cryptotraveler But did Ethereum ever actually promise fungibility and immutability in the first place?

@colbydillion Maybe; the fundamental difference is peoples value of machine versus social consensus.

@Papirys1 Unfortunately not. We were not notified of this meeting and had no chance to air any of our grievances with the bill.

Best case for Bitcoin: Ethereum doesn’t hard fork to recover funds and doesn’t soft fork to freeze funds, so attacker dumps ETH for BTC.

@el33th4xor Sounds like an opportunity for smart contract security reviewers and insurance providers :-)

@gacrux_nz @oleganza Recall that Ethereum has already hard forked in the past. It will hard fork again in the future.

@gacrux_nz @oleganza I don’t think it promised that. It seems a lot of people are finally realizing ETH & BTC have diff security models.

@oditorium @prestonjbyrne @Steven_McKie @rbtkhn Yep; if I held ETH, I wouldn’t want to hand over that much to an attacker to dump on market.

@prestonjbyrne @Steven_McKie @rbtkhn Correct. If Ethereum community comes to a consensus that this is the preferred state, so it shall be.

@GitKilbert No one knows, but no crypto system has the ability to peg a stable value relative to any other asset.

@rbtkhn It’s possible to change the contract to allow people to withdraw their ETH: https://t.co/H5n53Xe4UR

@JopHartog Depends upon your perspective - V has argued for years that root of consensus is social. ETH holders should know what they bought

@cannamellia It’s not negative - it’s a different model. Both have pros & cons.

@JopHartog I’d be willing to wager BTC that the plan will be enacted as described.

Ethereum has never and will never have Bitcoin’s security model. Expecting it to perform like BTC is setting yourself up for disappointment.

@colbydillion Trust & value would be affected regardless of if DAO holders got their funds back.

@JopHartog The plan for enabling DAO holders to retrieve their funds has already been published.

@WhalePanda If you mean the later buyers, not sure of the details. Pretty sure the original expectation was they couldn’t get premium back.

This may be Ethereum’s first Goxxing, but unlike Gox, all funds are accounted for and will be returned in a timely fashion. #SilverLining

Final verdict: no. https://t.co/F7FhxNidme

@TuurDemeester Will ETH holders flee to the safety of BTC?

MrChrisEllis “theDAO will be winded down completely and transformed into a simple contract where you can only withdraw” pic.twitter.com/NAUkHO4u7O

jgarzik Snarking about #ethereum intervention by #bitcoin community is misplaced: BTC saw heavy intervention early in life too.

If The DAO attacker “gets away with it” then this will turn into a test of Ethereum’s privacy and fungibility.

@RyanRadloff More people are using smart wallets that won’t create low fee transactions that get stuck.

The result of deploying a large attack surface. How the devs handle this crisis is critical. https://t.co/02uoRtT1Xi

@oleganza Vitalik’s view is that the root of all consensus is social and he has a point. Similar coordination happens during Bitcoin crises.

@alansilbert Skyrocketing - Bitcoin is failing its way upmarket every day! https://t.co/Ds97SwmFwC

@alex Due to full blocks it is more competitive to get transactions confirmed. I wrote an article about fees & UX: https://t.co/jUCX9qAD0a

mikebelshe Blockchain fees up 3x YoY. (fees-per-block / tx-per-block * daily BTC price) pic.twitter.com/O1HFpkQzX6

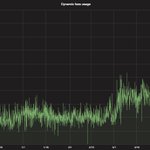

We appear to have surpassed 50% adoption of dynamically calculated bitcoin transaction fees last month. pic.twitter.com/2TnRQIqDhs

Child Pays for Parent has been merged into @bitcoincoreorg https://t.co/WETwg7vyXB

@juscamarena I’d expect it to be higher as well, assuming there still aren’t off-chain networks that are reliable & easy to use.

@deadalnix If you aren’t making transactions, the transaction fees are irrelevant! ;-)

If BTC->USD reaches $10,000, will the average transaction fee be over $3? There’s only one way to find out: HODL! https://t.co/cLm84QLja6

Predicting the future is hard; hope you bought the dip… https://t.co/zCrB4eAH8w

@kristovatlas @ryaneshea Where are my blaster pistols, Silicon Valley!?!?

@socrates1024 You’d have to ask @TradeBlock, but I doubt “Total Value” is “Unique Value”

@socrates1024 Total value doesn’t have as much meaning anyway since we don’t know how many coins are lost.

@socrates1024 A better comparison is likely to the daily txn volume which also includes value that’s spent multiple times.

@seweso *shrugs* anyone who claims to be able to tell real usage from attack transactions is just guessing.

@killerstorm I mean an economic effect because the value in unconfirmed txns is essentially frozen - it’s not safe to spend unconfirmeds.

3) These txns paid 20 sat / byte, well below where the current “floor” appears to be. Is someone abusing @YourBTCC’s BlockPriority service?

2) The 3 red clusters picture above are:

https://t.co/lVi0gViZJv

https://t.co/Zc4bkHZ878

https://t.co/sXqTkVw9Ue

All mined by @YourBTCC

1) Something funky happening on the blockchain? Lots of clusters just in a 10 min period. gappleto97.github.io/visualizer/ pic.twitter.com/DwICuB26U3

@BTCoinInformer Looks like we’re coming up on 24 hours for some of the oldest ones.

@josephjpeters So… no effects? Will we never reach a critical threshold because users will simply stop sending transactions?

1.68% of all BTC value is unconfirmed - about 10% of daily txn volume. At what point does this have a ripple effect? pic.twitter.com/cOpzScx7cb

“Bitcoin fees are like a 7c toll bridge, but half the drivers are throwing a quarter as they drive past.” https://t.co/MhAMDKvHzc

@prestonjbyrne It’s amazing how so many people have the ability to predict the futures of alternate timelines.

@ajtowns Ideally this would always be the case, but I’m quite sure many txns are automated / not presented to a human for a fee decision.

RT @BitGo: Proud of BitGo saving people real money with Dynamic Fraud Filters. https://t.co/5NVYRk73vZ

@SenBillRabon @SenatorBobRucho @jerrytillman /cc @shannonNullCode @LoyyalCorp @Papirys1 @Cryptolina @TriangleBitcoin @HiveDrive

.@SenBillRabon @SenatorBobRucho @jerrytillman: next time invite companies most impacted by regulation: startups. https://t.co/YfxzrLdBvd

A web site FAQ of exemptions can be changed on a whim: it is insufficient protection for startups. https://t.co/tAhQ6AU5R9

Sounds like nothing has changed since we last looked at it, meaning there are many concerns. https://t.co/YfxzrLdBvd https://t.co/okDpmACDpU

@bedehomender Miners collect whatever transactions are paying the highest fees.

@el33th4xor I guess it could ratchet down if enough users stop using Bitcoin :-P

6) As a result, it seems that an increasing exchange rate is another factor that pushes low value transactions off of the network.

5) Thus it appears that if blocks remain full, the fee rates remain the same in terms of satoshis per byte regardless of exchange rate.

4) This creates a fee rate standoff: there’s a first mover disadvantage to lowering txn fee rates to compensate for increased exchange rate.

3) If the exchange rate spikes & a wallet decides to lower the fee rate it pays, those wallet users will now suffer from delayed confirms.

2) As the BTC / fiat exchange rates go up and down, fee estimate algos don’t take them into account because they are irrelevant to miners.